Responding to TC123FD Recommendations

Disclosure based on TCFD recommendations

Nankai Group is based around stations in areas along our railway lines, and is committed to providing safe, secure, and comfortable transportation services. By combining a variety of services for all aspects of daily life, such as residential, office, and commercial development, the Group is promoting the creation of towns that are "environmentally friendly," "friendly to people of all generations," and "resilient to natural disasters."

In recent years, the impact of natural disasters has been increasing year by year, and the importance of responding to climate change is rapidly increasing throughout society.

The Group recognizes that responding to climate change is an important management issue for the future continuity of its business, and is working to identify the various risks and opportunities arising from climate change and to integrate them into its business strategies.

In addition, in September 2021, we endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and are working to enhance disclosure of information on "governance," "strategy," "risk management," and "metrics and targets" in line with those recommendations.

Governance

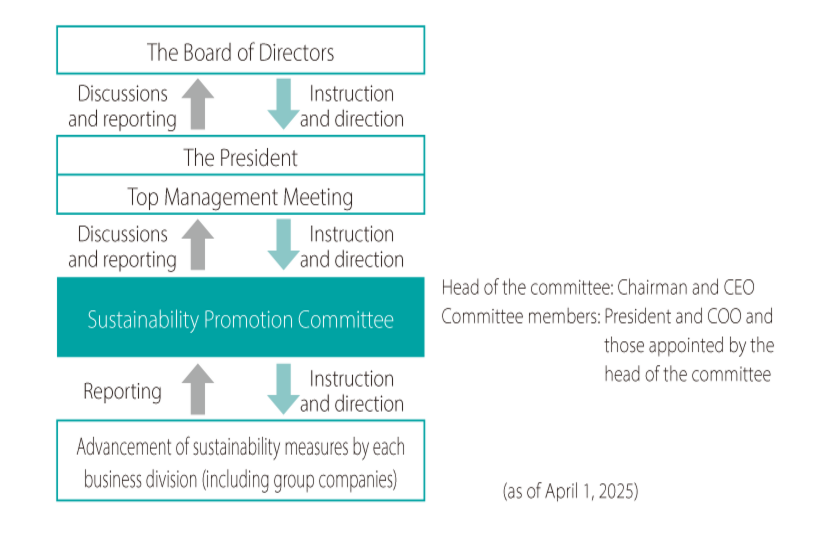

We have established the Sustainability Promotion Committee (meeting approximately twice a year) as an organization to promote sustainability measures across the entire group. This committee plays a central role in coordinating with business divisions to set goals for sustainability measures, monitor progress, promote achievement evaluations (PDCA cycle), identify climate change risks, and discuss ways to respond.

Important matters discussed by the Sustainability Promotion Committee are reported to the Board of Directors twice a year.

strategy

The Group is identifying and analyzing risks and opportunities related to climate change, assuming various possibilities for the future progression of climate change and changes in the economy and society. In fiscal 2024, the following companies and group companies (hereinafter referred to as "target companies") were included in the analysis.

| company | Industry |

|---|---|

| Our company, Semboku Rapid Railway Co., Ltd. * | Railway business, real estate and distribution business |

| Nankai Real Estate Co., Ltd., Nankai Shoji Co., Ltd. | Real estate and distribution business |

| Hankai Electric Tramway Co., Ltd. | Orbit business |

| Nankai Bus Co., Ltd., Kansai Airport Transportation Co., Ltd. Nankai Wing Bus Co., Ltd., Tokushima Bus Co., Ltd. | Bus business |

| Nankai Ferry Co., Ltd. | shipping industry |

*Our company will absorb Semboku Rapid Railway Co., Ltd. on April 1, 2025.

In the analysis, we first considered the magnitude of the business impact, and assigned a "high" importance rating to the following risk and opportunity items associated with the transition to a decarbonized society: "carbon prices, carbon emission targets and policies of each country," "regulations on products and services," and "electricity and fuel prices and changes in the energy mix," as well as "increasing severity of extreme weather" as a physical risk and opportunity item brought about by climate change. (The analysis was conducted for the 1.5-2°C scenario and the 4°C scenario.)

We have been working to address these risks and opportunities within the risk management systems of each core business division. For example, to address transition risks in the railway business, we are promoting the introduction of energy-efficient rolling stock, and to address physical risks, we are strengthening slope disaster prevention measures in mountainous areas.

Going forward, we will aim to achieve both sustainable growth in corporate value and the realization of a sustainable society by taking appropriate measures to address the risks and opportunities we identify.

| Risk Items | Risks to the Group | Time of occurrence | Direction of countermeasures | |

|---|---|---|---|---|

| Policy/Regulation | carbon pricing, Carbon emission targets and policies of each country | 【common】 Increased tax burden due to carbon tax Increase in electricity costs due to shift to renewable energy to achieve CO2 reduction targets | Medium to long term | - Investments in vehicle renewal and equipment renewal, etc. Promoting energy conservation ・Introduction of renewable energy ・Utilizing carbon offsets ・Utilizing internal carbon pricing |

| [Real Estate/Distribution] Increased costs for purchasing emission credits for aging properties | ||||

Product and service regulations | 【bus】 Increased costs for introducing EV/FCV buses | ・Construction costs and costs will be reduced by reviewing equipment specifications and procurement methods. Reducing renovation costs and utilizing subsidy systems | ||

| Industry/Market | electricity and fuel prices, Changes in the energy mix | 【common】 Increased facility operating costs due to increased renewable energy ratio | short to long term | - Energy conservation through investment in vehicle and equipment renewal promotion ・Promoting in-house use of renewable energy |

| Risk Items | Risks to the Group | Time of occurrence | Direction of countermeasures |

|---|---|---|---|

| Policy/Regulation | [Real Estate/Distribution] Increased construction and renovation costs to comply with regulations | middle period | ・Construction costs and costs will be reduced by reviewing equipment specifications and procurement methods. Reducing renovation costs and utilizing subsidy systems |

| technology | 【common】 Increase in construction costs due to the introduction of new energy-saving and renewable energy technologies | - Reducing construction costs by reviewing equipment specifications and procurement methods, Utilizing government support measures such as subsidy programs | |

| [Railways, tracks, buses] Decrease in customers and revenue due to the spread of eco-friendly cars | long term | ・The strengths of railways, such as mass transit and punctuality, Evolving into a comprehensive mobility business by leveraging | |

| [Real Estate/Distribution] Increased costs of responding to technological innovation, and delays in responding Possibility of reducing rent received from tenants | |||

| reputation | 【common】 Changes in customer reputation: Decrease in customers due to negative evaluation of environmental measures | middle period | ・Actively promoting and disseminating information on environmental measures, such as energy conservation measures |

| [Real Estate/Distribution] Possibility of a decrease in our rental income due to a decrease in tenants | |||

| 【common】 Changes in investor reputation: Passive environmental measures lead to sluggish stock prices, Rising financing costs and divestment | ・Promoting proactive environmental measures and publishing integrated reports and websites Disclosure of information on climate change response based on TCFD recommendations |

| Risk Items | Risks to the Group | Time of occurrence | Direction of countermeasures |

|---|---|---|---|

| Increasing severity of extreme weather | 【common】 ・Flooding of railway lines and owned real estate, landslides, and bridge scouring Increased losses, increased non-life insurance premiums, and decreased asset values due to the occurrence of - Business suspension of commercial facilities and railway and Bus service suspensions, ferry cancellations, etc. Decrease in revenue due to increased hotel and travel cancellations ・Business disruption due to supply chain disruptions | Short to medium term | - Reinforcement work on railway facilities, real estate and distribution facilities, and flooding Prevention measures, measures to prevent landslides on slopes, cutting down dangerous trees ・Implementing measures to prevent bridge scouring ・Regulation level by strengthening hardware measures for railway facilities Relaxation of ・Securing inventory, etc., at railway facilities, real estate and distribution facilities Strengthening BCP response capabilities - Vehicle evacuation during bad weather ・Disaster response manuals, including diversifying supply chains Development of ・Reducing disaster damage through insurance |

| Risk Items | Risks to the Group | Time of occurrence | Direction of countermeasures |

|---|---|---|---|

| Changes in precipitation and weather patterns | [Railway] Increased transportation costs due to increased rainfall and strong winds | middle period | - Planned implementation of hardware measures for railway facilities ・Preventive maintenance using digital technology |

| [Real Estate/Distribution] Deterioration of building materials due to ultraviolet rays and storms Declining asset values | |||

| Rising average temperatures | 【common】 The number of passengers and visitors has decreased due to the extreme heat, Increased costs due to heatstroke and reduced productivity | ・Facility design and construction taking into account extreme heat | |

| [Train and bus] Increased costs due to air conditioning | |||

| [Real Estate/Distribution] Increased construction costs due to increased air conditioning capacity, etc. | |||

| Sea level rise | [Train and bus] Damage to facilities and vehicles due to flooding along coastal routes | long term | ・Strengthening railway facilities through flood prevention measures - Preparation of evacuation plans for railway vehicles |

| Opportunity Items | Opportunities for the Group | Time of occurrence | Direction of countermeasures |

|---|---|---|---|

| Resource Efficiency | 【common】 Energy-saving investment reduces operating costs, and public support and Increased tax reduction potential | Medium to long term | ・Promoting energy conservation through investment in vehicle and equipment renewal ・Promoting in-house use of renewable energy |

| Products and service | [Railway] Shift from road transport to rail transport due to the introduction of a carbon tax | ・Promoting energy conservation through investment in vehicle and equipment renewal | |

| 【bus】 Implement and strengthen policies and subsidy systems to promote the spread of EV/FCV buses | ・Utilizing subsidy systems | ||

| [Real Estate/Distribution] ・Increasing demand for new buildings with high environmental performance Rising rents and improved asset values ・Providing disaster-resistant facilities with BCP support and measures for those unable to return home Strengthening competitiveness and increasing revenue by meeting tenant needs | Short to medium term | ・Increase in the number of buildings that have acquired environmental certification and proactively update facilities to improve environmental performance ・Strengthening disaster response capabilities of real estate and distribution facilities in the Namba area ・Preparing disaster response manuals and disclosing information on BCP measures | |

| Resilience | 【common】 If you are able to adapt to changes in the energy mix, Increased business resilience | ・Promoting energy conservation through investment in vehicle and equipment renewal ・Promoting in-house use of renewable energy |

| Opportunity Items | Opportunities for the Group | Time of occurrence | Direction of countermeasures |

|---|---|---|---|

| Resource Efficiency | 【common】 Energy-saving technology reduces power and operating costs | middle period | - By spreading new technologies and utilizing new subsidy systems Promoting the introduction of high-performance vehicles and equipment |

| [Railway] Achieving lower prices for environmentally friendly vehicles and durability for long-distance driving | long term | ||

| 【common】 Lower heating costs in winter due to rising average temperatures | middle period | ・Reduction of capital investment in heating functions by simplifying specifications | |

| Energy source | 【common】 Lower prices and cost reductions for renewable energy | long term | ・Introduction of renewable energy |

| Products and service | [Railway] A modal shift from private cars to rail due to rising environmental awareness among customers | middle period | ・Evolve into a comprehensive mobility business that encourages a shift from private cars to public transportation |

| [Real Estate/Distribution] ・Enhanced environmental performance reduces operational costs and improves competitiveness ・Subsidies for meeting the standards for long-term quality housing (ZEH standards) Eligibility for tax incentives and the impact on profits and losses due to improved customer ratings ・Increased revenue through successful differentiation in response to increasing customer needs for environmental performance | middle period | ・Introduce energy-saving equipment necessary for ZEB/ZEH and actively utilize subsidy systems - Promoting sales of highly airtight and highly insulated detached houses, Promoting sales of insulation renovation package products for renovations ・Development of high environmental performance buildings and ZEB/ZEH | |

| [Real Estate/Distribution] ・Due to the deterioration of safety at competing logistics facilities on the bay due to the intensification of extreme weather, Relative increase in the value of company properties | short to long term | ・Promoting the upgrading of logistics facilities in inland areas | |

| market | 【common】 As ESG investment expands, funding becomes more active | middle period | ・Securing funds through green investments to proactively promote environmental measures |

[Common] refers to items generated by railway, railroad, bus, shipping, real estate and distribution businesses.

Occurrence period Short term: 1 year, Medium term: 2 to 4 years, Long term: 5 to 15 years

The direction of countermeasures includes those currently under consideration for implementation.

Of the identified risks and opportunities rated as "high" in the importance assessment, we quantitatively estimated the business impact within the "scope of concern" in society in 2030 for those for which objective future forecast data on temperature rise scenarios has been made public.

The assumptions were based on a 1.5-2°C scenario in which society takes proactive measures to combat climate change, and transition risks and opportunities were calculated based on a 1.5-2°C scenario and a 4°C scenario in which physical risks were calculated.

| item | Risks and Opportunities | Prediction data used for the calculation | Estimated impact in 2030 | |

|---|---|---|---|---|

| 1.5-2°C scenario | 4°C scenario | |||

| Transition Risk | Decrease in operating profit due to carbon tax | IEA「World Energy Outlook 2024」 | 140$/t-CO2 (2030, developed countries) Exchange rate: 1$ = 128.3 yen | ー |

| Increased costs for introducing EV/FCV buses | Mizuho Research & Technologies Co., Ltd. EV bus market analysis survey results | Assuming EV adoption rate of approximately 5% | ー | |

| Decrease in operating profit due to rising electricity prices | IEA「World Energy Outlook 2018」 | Approximately 5% increase compared to current levels | ー | |

| Physical Risks | Physical damage caused by heavy rain (flood *1, landslides, bridge scouring) Decrease in operating profit due to | Technical Review Committee on Flood Control Planning Based on Climate Change "Proposal for flood control planning taking climate change into account" A-PLAT "Climate Change Adaptation Information Platform" | Compared to the current level Flood frequency approximately doubled Landslides, bridge scouring 2% increase in occurrence | Compared to the current level Flood frequency increases by approximately four times Landslides, bridge scouring 2% increase in occurrence |

| Railway suspensions due to increased heavy rainfall and Facility closed *2 Decrease in operating profit due to | Japan Meteorological Agency "Climate Change in Japan 2020 - Atmosphere, Land, and Ocean" Observation and Prediction Evaluation Report (Detailed Version) Ministry of the Environment and Japan Meteorological Agency "Japan's Climate at the End of the 21st Century (2015)" | Compared to the current level Number of days of heavy rain per year 0.6 day increase | Compared to the current level Number of days of heavy rain per year 1.2 day increase | |

| opportunity | Increased rents for existing buildings due to environmental certification | Japan Real Estate Institute "48th Real Estate Investor Survey Special Questionnaire II" | Approximately 3% increase compared to current levels | ー |

1. Yamato River and Kinokawa River basins

2 Namba City, Namba Parks, Namba station Nankai Assume commercial sales store

| item | Risks and Opportunities | Estimated impact in 2030 | |

|---|---|---|---|

| 1.5-2°C scenario | 4°C scenario | ||

| Transition Risk | Decrease in operating profit due to carbon tax | ▲ 2.8 billion yen/year | ー |

| Increased costs for introducing EV/FCV buses | |||

| Decrease in operating profit due to rising electricity prices | ▲ 300 million yen/year | ー | |

| Physical Risks | Decrease in operating profit due to physical damage caused by heavy rain (floods, landslides, bridge scouring) | ▲ 100 million yen/year | ▲ 300 million yen/year |

| Decrease in operating profit due to train service suspensions and facility closures caused by increased heavy rain | ▲ 100 million yen/year | ▲ 300 million yen/year | |

| opportunity | Increased rents for existing buildings due to environmental certification | 300 million yen/year | ー |

As a result of the calculations, the business impacts of the anticipated impacts of climate change due to the risks and opportunities of transitioning to a decarbonized society were calculated. Regarding the business impact of physical risks, the estimated impact amount under the 4°C scenario was approximately 1.9 times greater than under the 1.5-2°C scenario.

Regardless of the scenario, the business impact is expected to be limited. However, in order to minimize the risks and maximize the opportunities posed by climate change, we aim to remain a climate change resilient organization through initiatives aimed at realizing a decarbonized society, such as promoting CO2 reduction measures, including the renewal of railway vehicles.

Risk Management

Regarding risks to the Group's businesses, we have established a Risk Management Committee (chaired by the President and COO) and are conducting comprehensive and unified risk management for the entire Group, in an effort to avoid or mitigate risks that could have a significant impact on the management of the Group.

The Risk Management Committee has determined eight top risks that should be addressed as a priority, including "environment" and "personnel/labor" risks. The top risks are divided into operational risks and management risks, and risk owners who are responsible for promoting risk countermeasures are selected. For operational risks, risk countermeasure plans are implemented mainly by risk managers who are responsible for implementing them, while for management risks, risk owners report risk trends to the Risk Management Committee to improve effectiveness.

The efforts of these risk owners and risk managers (first line) and the Risk Management Committee (second line) are audited by the Internal Audit Office (third line), creating a system known as "three lines of defense."

In addition, the Sustainability Promotion Committee (chaired by the Chairman and CEO) is responsible for formulating various policies and strategies to minimize risks and seize opportunities related to climate change and human capital, and for managing the monitoring of initiatives. In cooperation with the Risk Management Committee, the committee regularly implements initiatives to reduce risks.

Indicators and Goals

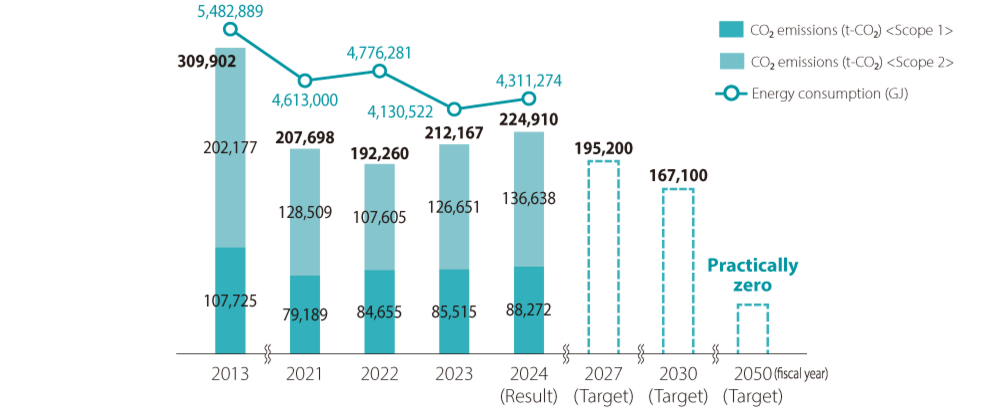

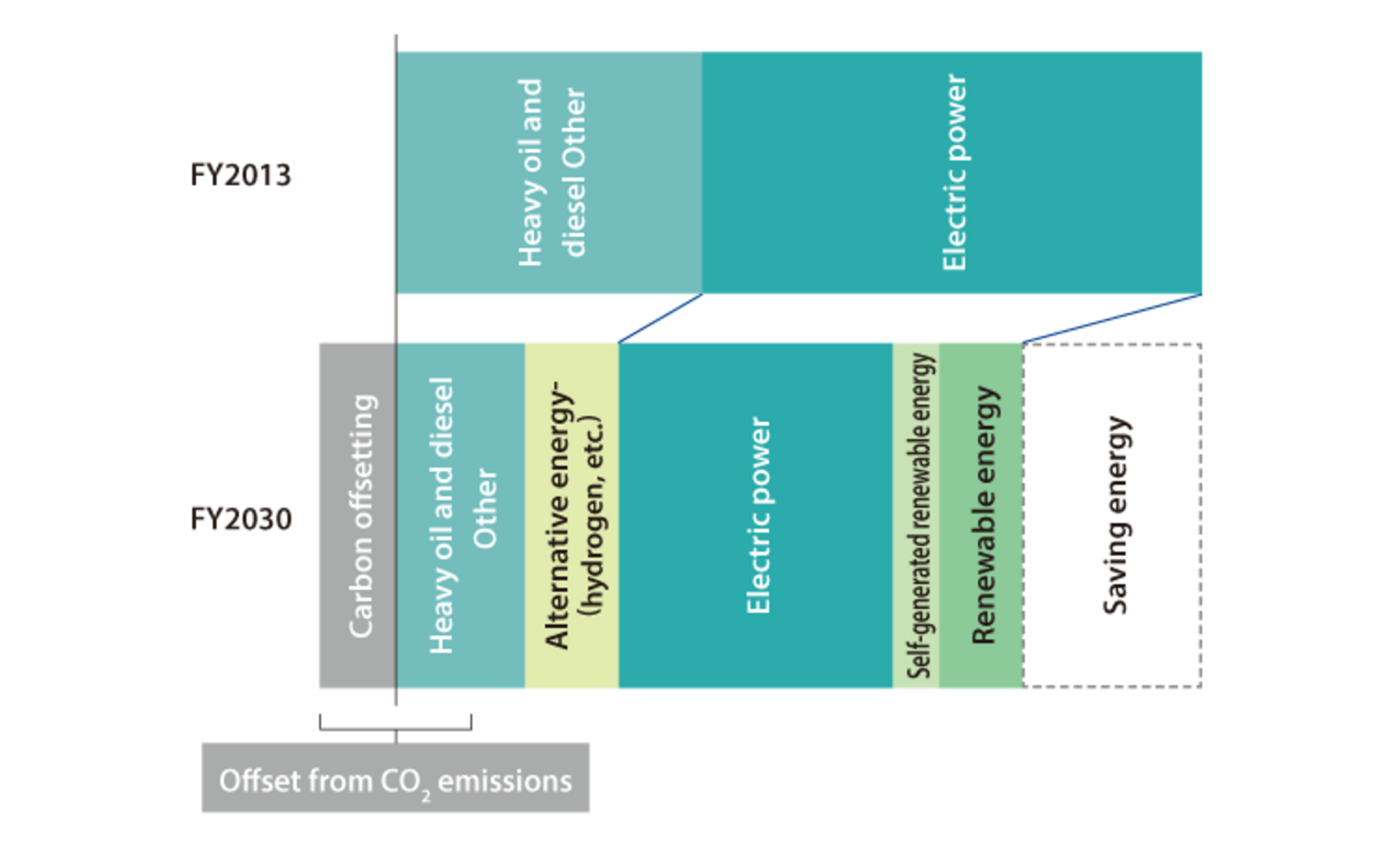

To mitigate climate change and prepare for transition risks, the Group is working to decarbonize its business activities and has set the following goals.

Scope 1 and 2

- Reduce CO2 emissions by more than 46% compared to fiscal 2013 (by fiscal 2030)

・Net zero CO2 emissions by 2050

Scope 1 and 2

- Reduce CO2 emissions by more than 46% compared to fiscal 2013 (by fiscal 2030)

・Net zero CO2 emissions by 2050

To achieve these goals, we measure progress in the railway business division against the following indicators:

・Increase the rate of energy-efficient vehicles to 85% (by fiscal 2030)

・Increase the rate of energy-efficient vehicles to 85% (by fiscal 2030)

The JR East Group will contribute to the realization of a sustainable society through initiatives to reduce CO2 emissions, such as updating rolling stock and utilizing renewable energy.

The Group's CO2 emissions performance, reduction targets, energy consumption composition, and third-party assurance status are as follows:

Following on from last year, we have received third-party assurance from Deloitte Tohmatsu Sustainability Co., Ltd. for the "Nankai Group Energy-Derived CO2 Emissions Calculation Report (FY2024)" for our actual energy-derived CO2 emissions (Scope 1 and 2) for FY2024 (scope: our company and 54 consolidated subsidiaries).

| Scope 1 | Scope 2 | Scope 1+2 | |

|---|---|---|---|

| FY2024 Energy-originated CO2 emissions (t-CO2) | 88,272 | 136,638 | 224,910 |

Back Number

You can view past reports.