Shareholder Returns and Dividends

Shareholder return policy in the NANKAI Group Medium-term Management Plan 2025-2027

While upholding a policy of stable dividends, we will gradually increase the consolidated dividend payout ratio, aiming for around 30% by FY2027, and will flexibly acquire treasury shares as necessary.

Interim and year-end dividends

| Interim | Year-end | Total | |

|---|---|---|---|

| FY2024 | 17.50 yen | 22.50 yen | 40.00 yen |

| FY2025 (forecast) | 25.00 yen | 25.00 yen | 50.00 yen |

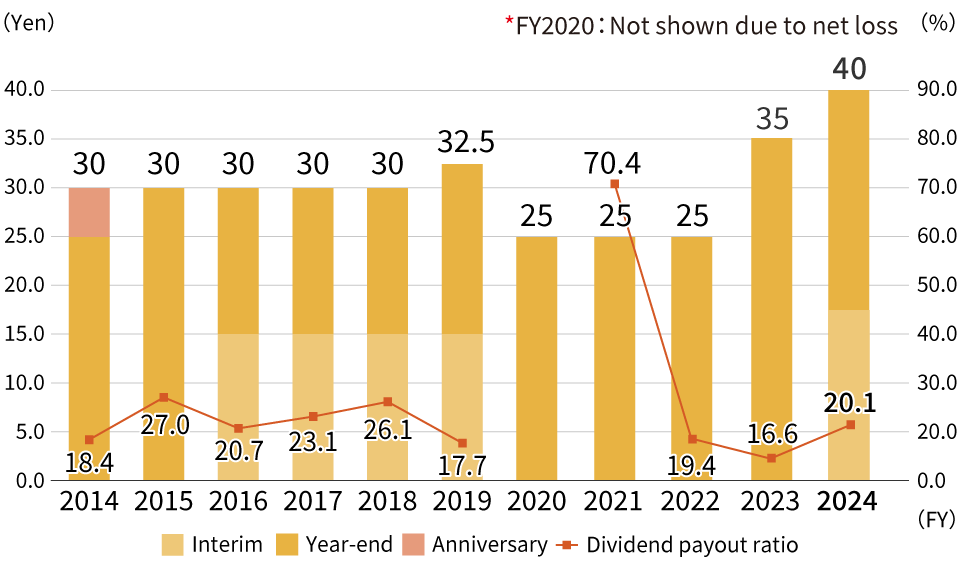

Changes in Dividends

| Accounting term | Interim | Year-end | Total | Dividend payout ratio |

|---|---|---|---|---|

| FY2014 | - | 25.00 yen (Anniversary dividend: 5.00 yen) | 30.00 yen | 18.4 |

| FY2015 | - | 30.00 yen | 30.00 yen | 27.0 |

| FY2016 | 15.00 yen | 15.00 yen | 30.00 yen | 20.7 |

| FY2017 | 15.00 yen | 15.00 yen | 30.00 yen | 23.1 |

| FY2018 | 15.00 yen | 15.00 yen | 30.00 yen | 26.1 |

| FY2019 | 15.00 yen | 17.50 yen | 32.50 yen | 17.7 |

| FY2020 | - | 25.00 yen | 25.00 yen | - |

| FY2021 | - | 25.00 yen | 25.00 yen | 70.4 |

| FY2022 | - | 25.00 yen | 25.00 yen | 19.4 |

| FY2023 | - | 35.00 yen | 35.00 yen | 16.6 |

| FY2024 | 17.50 | 22.50 yen | 40.00 yen | 20.1 |

* On October 1, 2017, we conducted a reverse stock split replacing every five ordinary shares with one share.

* Dividend figures for FY2017 and earlier have been calculated based on the number of shares following the reverse stock split.

Status of Purchase of Treasury Shares

We purchased treasury shares as follows from July 31, 2025, to January 30, 2026.

| Class of shares to be purchased | Shares of the Company’s common stock |

|---|---|

| Total number of shares purchased | 4,936,700 shares |

| Total purchase price | 11,999,781,812 yen |

| Purchase period | From July 31, 2025, to January 30, 2026 |

| Purchase method | Market purchases on the Tokyo Stock Exchange |

(reference)