Risk Management

Basic concepts

To fulfill our social responsibility through sustainable growth, we consider risk management to be a matter of utmost importance. As such, we have established the Risk Management Division as a department dedicated to risk countermeasures, and have appointed a Corporate Officer in charge of risk management. We address risk management with the Risk Management Regulations (including risks related to human rights) that serve as the basic policy for risk countermeasures. For risk countermeasures, we also introduced a risk management system based on ERM (Enterprise Risk Management) from FY2022, based on ISO 31000, an international guideline for risk management, and COSO’s internal control framework.

Establishment of the Risk Management Committee

Nankai Electric Railway has established a Risk Management Committee chaired by the President and COO. The Risk Management Committee strives to avoid or reduce risks that could significantly impact the Group’s management through comprehensive and integrated risk management for the entire Group, and also deliberates on various measures to promote compliance management. In principle, the Risk Management Committee meets once a month, subject to confidentiality obligations; in 2024, it met a total of 12 times to report on the operation of the corporate ethics hotline system and compliance risk-related reports and share their contents with the management team.

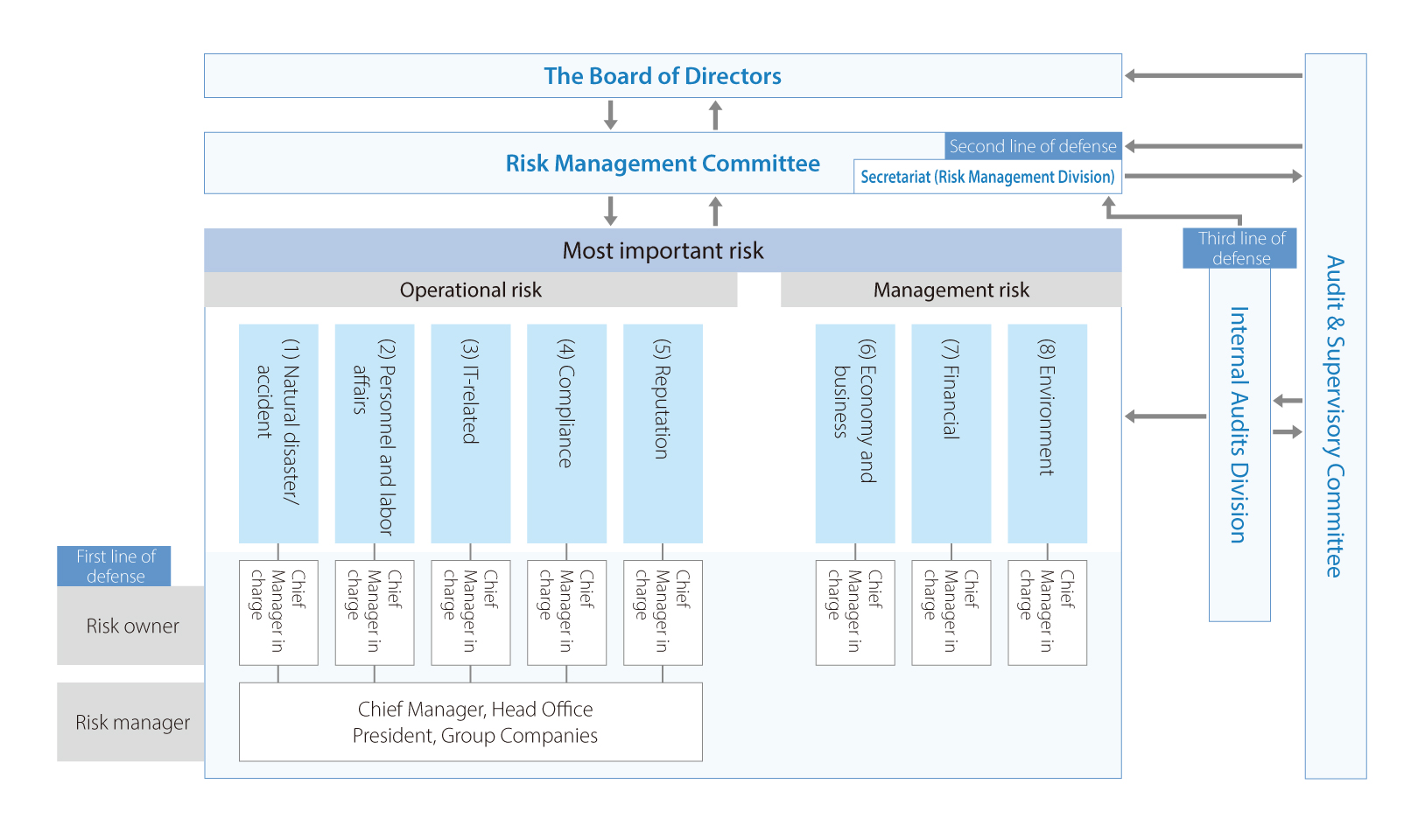

Risk management system

Addressing the most important risks

Based on the Risk Management Regulations, the Risk Management Committee determines the most important risks to prioritize. For the most important risks, we have divided (1) to (8) in the above figure into “operational risks” and “management risks,” and have selected the chief manager in charge as the risk owner, who is responsible for promoting measures to deal with each risk. With regard to “operational risk,” the risk management plan is implemented with the risk manager as the main person in charge, and with regard to “management risk,” the risk owner reports on risk trends to the Risk Management Committee. The Risk Management Committee regularly checks the status of these initiatives and implements improvements through the PDCA cycle.

Three lines of defense

The Risk Management Committee regularly checks the execution of risk countermeasure initiatives, coordinates with the Audit Committee and reports to the Board of Directors (three reports in FY2024 and tow reports in FY2025).

The Internal Audit Office audits these risk countermeasure initiatives and has a so-called ‘three lines of defence’ system in place.

Specifically, the risk owners and risk managers working on risk countermeasures at each workplace form the first line, while the Risk Management Committee, which verifies and supervises these efforts, constitutes the second line.

Furthermore, the Internal Audit Office acts as the third line, verifying the implementation status of risk countermeasure plans (first line) and the content of the Risk Management Committee's work (second line).

Business risks

Out of the risks associated with the Group’s businesses and others, primary risks that are considered to significantly affect investor decisions are described here. For active information disclosure, the matters that may not necessarily be such risk factors are also listed below if they are considered important for investors’ investment decisions. We are ensuring comprehensive, central risk management for the entire Group, by implementing measures such as establishing a Risk Management Committee, to avoid and minimize risks that could significantly affect the management of our Group. This document describes some of the measures to avoid risks and how to respond to those risks if they occur, but such measures will not necessarily reduce the risks or their impact.

This section includes matters concerning the future, but the descriptions are based on forecast made as of March 31, 2025.

(1) Economic conditions

The declining and aging population, populations in the areas along our railway lines, employment situations, and trends for the number of Kansai International Airport users, including tourists to Japan, are factors that may cause a decline in passengers in the transportation industry, including railway businesses. Sales from our real estate business, distribution business, leisure and services business, etc., could be affected by such factors, as well as by changes of economic trends inside and outside of Japan, consumer trends, and market needs. The performance of our Group can also be affected by currency fluctuations, higher power bills due to soaring oil prices, and by higher material prices.

Furthermore, fluctuations of share prices concerning investment securities and of land prices of our real estate may cause us to record impairment losses in shares and real estate with little profitability, which may then have a negative impact on our Group performance and financial status.

(2) Competition

In our railway business, some of the railways compete with other companies. People switching to using privately owned cars, motorbikes, and other means of transport could continue to affect our railway business.

In the bus business, the shortage of bus drivers is becoming increasingly severe nationwide. For our group, this could potentially impact performance depending on staffing levels. Free competition for new routes has been permitted. This will accelerate competition and could potentially affect our group's performance.

In the Namba area, which is central to our business, the Namba City and Namba Parks Shops & Diners shopping centers that we operate are competing with large shopping centers in other areas of Osaka City (such as Umeda and Tennoji).

(3) Legal regulations

In our railway business, pursuant to the Railway Business Act (Act No. 92, 1986), we need to obtain a license from the Minister of Land, Infrastructure, Transport and Tourism for every route and classification of railway business that we wish to operate (Article 3), as well as for setting and changing the upper limits of the fares and the charges for passengers (Article 16). There are no periods prescribed for these licenses and approvals by the Minister of Land, Infrastructure, Transport and Tourism.

The Minister of Land, Infrastructure, Transport and Tourism may order a railway operator to suspend its business for a certain period or may rescind the license if the operator violates this Act, an order under this Act, any dispositions based on them, or the conditions attached to the license or approval (Article 30). If a railway business operator intends to suspend its railway business, the operator must notify the Minister of Land, Infrastructure, Transport and Tourism to that effect by no later than one year in advance (Article 28-2).

At this point, there have been no facts that violate this law, nor any factors that disrupt the continuation of our railway business. However, if we violate this Act and cause our business to be suspended or our license to be revoked by the Minister of Land, Infrastructure, Transport and Tourism, it could significantly affect our business activities.

Furthermore, our Group’s businesses are governed by various laws and regulations and if such laws and regulations are tightened, it could affect our Group performance and financial status negatively, such as an increase in expenses to comply with such rules.

(4) Real estate properties for mass sales

For our mass-sales real estate, we attempt to recover the investment by systematically selling them, but the economic situation has been tough for large-scale suburban home development due to factors such as land prices falling, especially in suburban areas, and more people wanting to live in central area. Even though we will continue to sell these properties according to plan, we could see some impact, such as a delay in recovering the investment, because demand for homes is expected to decline as the population continues to decline, and because the trend of people wanting to live in central area is expected to accelerate.

(5) Matters concerning our Group companies

Our consolidated subsidiary Nankai Tatsumura Construction Co., Ltd is our only listed Group company as well as a core company within our Group, so we have been supporting its management through means such as third-party share allotment and providing support fund. However, if the company sees unexpected situations, such as the environment for the incoming orders changing, it could negatively affect our Group performance and financial status.

(6) Investments

Investments in the railway business require various renewal investments for infrastructure that involve a long time and significant costs, such as for continuous flyover roadway constructions and constructions for safe operations. Procuring such funds and paying interests affect our Group performance and financial status.

(7) M&A

For M&A as our growth strategy, we ensure meticulous due diligence on the financial status and other attributes of the target company with external specialists, etc. However, if any contingent liabilities, unidentified debts, etc., that were not detected by the due diligence become prominent, they could negatively affect our Group performance and financial status.

If the profitability of the target company declines with changes in the business environment after the M&A, and if the expected synergy is not achieved, our Group performance and financial status could be negatively affected, such as the need to acknowledge impairment losses, resulting in inability to recover the investment.

(8) Accounting for retirement benefit

For retirement benefit asset and retirement benefit liability, the Company records the amount obtained after deducting the pension asset from the retirement benefit debt based on the amount projected for the end of the consolidated accounting year, to prepare for employee retirement benefits. The difference in the calculation is covered in the next consolidated accounting year using the straight-rate method for a certain number of years (3 to 11 years) within the average remaining working period of the employee as of the time when the difference is identified. If the condition to calculate the debt is changed or there is further decline of return on investment, it could negatively affect our Group performance and financial status.

(9) Interest-bearing debts

Due to the nature of our businesses, our financial portfolio remains highly reliant on borrowings, and issuing large amounts of bonds payable and borrowing from banks to cover capital investment and M&A could further increase our interest-bearing debt. Even though we will diversify our means of procuring funds to maintain sound finance, an increase in interest payment due to interest fluctuations could negatively affect our performance. If rating companies lower our rating, it could negatively affect our Group performance and financial status.

(10) Natural disasters

Major earthquakes such as the Nankai Trough Earthquake, the tsunamis they cause, and natural disasters such as gales, floods, and erosions from typhoons that cause significant damage to our facilities and infrastructures could negatively affect our Group performance and financial status. We have been systematically making seismic reinforcements to our railway facilities, including overpass pillars and buildings, and taking various measures to prevent and reduce the impact of disasters on bridges, etc. To respond to major natural disasters, including accidents as illustrated in (11) and (12), we have been reinforcing our management systems to minimize damage by implementing measures, such as establishing disaster-response rules, etc., establishing business continuity planning (BCP) assuming major earthquakes, and introducing commitment credit lines for earthquakes. However, the scope of damage could expand depending on the region, scale, season, and time of the disaster. Even if our facilities are not directly damaged, railway transport could be significantly disrupted by damage in facilities of Class-3 railway business operators, restriction of power supplies, and difficulty in procuring parts for train operation, etc., associated with major natural disasters.

Furthermore, the spread of infectious diseases such as the novel coronavirus may adversely affect the Group's business performance and financial position.

(11) Accidents and system failures

Transportation is the core of our Group’s businesses and our greatest mission is the provision of safe and secure transportation services, so accidents, fires and explosions at our facilities, and serious incidents (incidents that could cause accidents) could make us lose the trust of the public, and significantly affect our performance to cover recovery efforts, damage claims, etc.

System failures from human errors, equipment malfunction, etc., could disrupt our business operation, and the cost incurred, etc., to restore facilities and arrange alternative transportations could make us lose the trust of the public and negatively affect our performance and financial status. To prevent accidents and system failures, we will take further measures, such as organizing various security facilities and station office systems, performing updates and periodical maintenance work, and providing thorough employee training.

(12) Third-party acts and terrorism

We take measures for accidents, terrorism, illegal access, etc., by third parties, such as by watching out for suspicious objects, enhancing facility patrols, and ensuring information security, but if terrorism, etc., still occurs despite our measures, it could disrupt our business activities.

(13) Failures and damages in our assets and products

If failures and damages are found in our Group assets, or if the possibilities of such assets affecting people’s health and their surroundings, etc., are pointed out, costs may be incurred to improve such assets, restore them to their original state, cover damages, etc. If there is a fault or defect found in the products and real estate sold by the Group, construction performed by the Group, services provided by the Group, etc., our Group performance and financial status could be negatively affected by the cost of improving and covering such damages, and by the loss of the public’s trust, etc.

(14) Action against climate change

The Group’s performance and financial status could be negatively affected by the increasing cost of transforming to a decarbonized society to ease climate change, and by natural disasters that have become more severe with climate change. We have been evaluating measures to alleviate and respond to climate change. Under such circumstances, we agreed to the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), and have been disclosing information based on the recommendations. We wish to keep making efforts to play our part in realizing a sustainable society through our initiatives to contribute to preserving the global environment, which is one of our key sustainable themes (materiality).

(15) Human resource policy

The transportation business, which includes railways and buses, requires a steady supply of personnel for business operation, because it has a labor-intensive business structure. In order to drive our business strategies of developing the most popular areas along railway lines and deepening and expanding the real estate business, we need to keep working on securing and developing diverse specialists. If these policies are delayed due to changes in the environment, etc., it could negatively affect our Group performance and financial status.

(16) Information asset management

Our Group stores not just the personal information of customers and employees in each business, but also important information (including confidential information). Therefore, to enhance risk management, we have organized internal rules, such as basic information security policy, and are training employees, etc. However, should such information leak for whatever reason, it could result in liabilities, the loss of the public’s trust, and a negative impact on the Group’s performance.

(17) Compliance

To establish corporate ethics and maintain or promote compliance management, the Group has been conducting awareness activities such as regularly providing compliance education. To detect and correct legal and ethical issues early, we have established an internal whistleblower system, but if significant unjust and illegal acts are found, the Group could lose the trust of the public and it could negatively affect the Group’s performance and financial status.

(18) Significant disputes

At this point, there have been no serious disputes that could significantly affect our business management.

For our business development going forward, we will strive to execute agreement provisions earnestly in all our businesses. However, we may not have any choice but to file lawsuits for actions by other parties that are against the principle of good faith, or be served with lawsuits by other parties for differences of perception or malicious intent. Furthermore, the outcome of lawsuits, etc., could make the Group lose the trust of the public, or negatively affect the Group’s performance and financial status.