Medium-term Management Plan

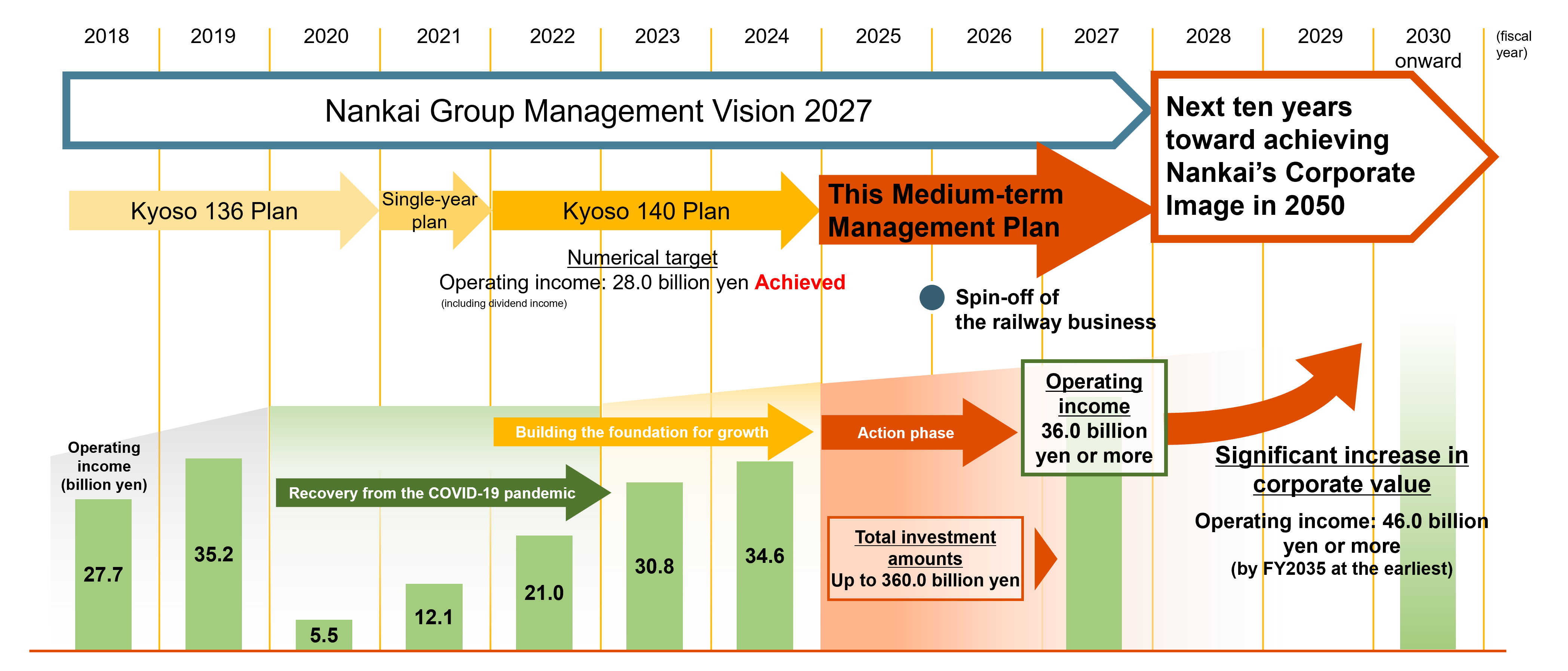

Three years of taking action to significantly increase corporate value, after recovering from the COVID-19 pandemic and building the foundation for growth

NANKAI Group Medium-term Management Plan 2025-2027

Period

FY2025 to FY2027 (three years)

Overview

[Basic policies]

To continue fulfilling our social mission while maintaining profitability, we will prioritize strengthening our core businesses through concentrated investment to significantly increase corporate value

[Positioning of this Medium-term Management Plan (timeline)]

[Strategy Summary]

Priority strategy

・Accelerated expansion of the real estate business

・Transformation into a public transportation business that paves the way for the future

Foundation strategy

・ Scaling new businesses while continuing to explore the future

・ Realization of efforts to “develop the most popular areas along our railway lines, which continue to be preferred”

・ Strengthening the link between corporate strategy and business strategy

*Human resources strategy, DX strategy, Financial strategy

Priority strategy (*Top priority)

Accelerated expansion of the real estate business

Achieve accelerated expansion by adding inorganic methods such as M&A to the options

Shift from our landlord business to an integrated real estate business

[Major initiatives]

・Expansion of business areas

・Diversification of schemes

・Deepening of existing fields

[Investment amount (FY2025-FY2027) ]

・Revenue expanding…Up to 175.0 billion yen

・Safety and renewal…Up to 38.0 billion yen

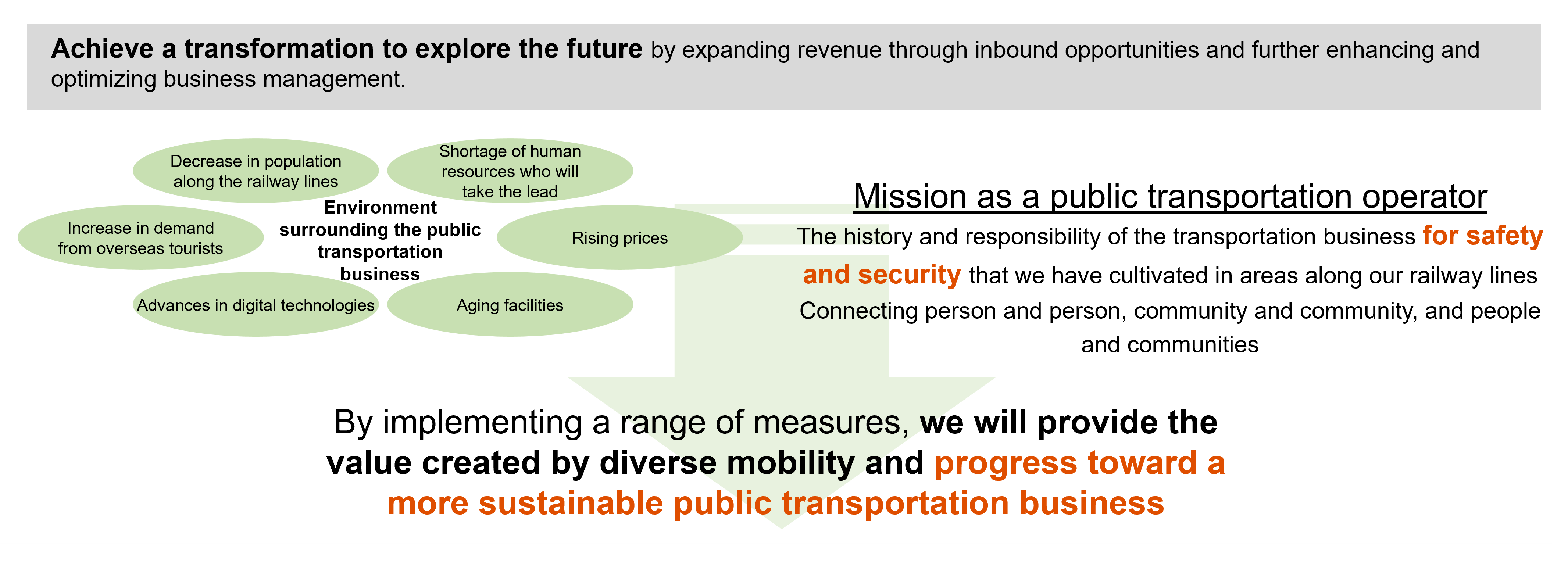

Transformation into a public transportation business that paves the way for the future

With a sense of urgency that the business’s future is at risk if the current situation continues,

we will make concentrated investments necessary for the future and take on the challenge of sustaining the business’s growth

[Major initiatives]

・Enhancing and optimizing business operations

・Strengthening profitability and efforts to capture inbound tourism demand

・Improving service quality (improving the brand)

・Providing safety, security, and trust; taking disaster countermeasures

[Investment amount (FY2025-FY2027) ]

・Revenue expanding…Up to 19.0 billion yen

・Enhancing management…Up to 34.0 billion yen

・Existing facility updates, etc.…Up to 74.0 billion yen

Foundation strategy

Scaling new businesses while continuing to explore the future

We will scale our business with a particular focus on the two businesses of e-sports and tourism. While nurturing the seeds of new businesses outside of real estate and public transportation, we will review our approach to new field development to enhance feasibility.

Realization of efforts to “develop the most popular areas along our railway lines, which continue to be preferred”

Improving the value of areas along our railway lines, with a focus on priority areas. (①Namba (to Shin-Imamiya) ②Semboku, Kongo, Sayama ③Senshu)We aim to revitalize the area by encouraging repeat visits and implementing measures to improve customer satisfaction and the image of the areas along our railway lines, thereby increasing the number of people interacting and the number of people who will eventually settle.

Strengthening the link between corporate strategy and business strategy

Human resources strategy : Accelerate human capital management

DX strategy : Increase digital customer contact points

Financial strategy : Optimize capital structure and secure investment funds

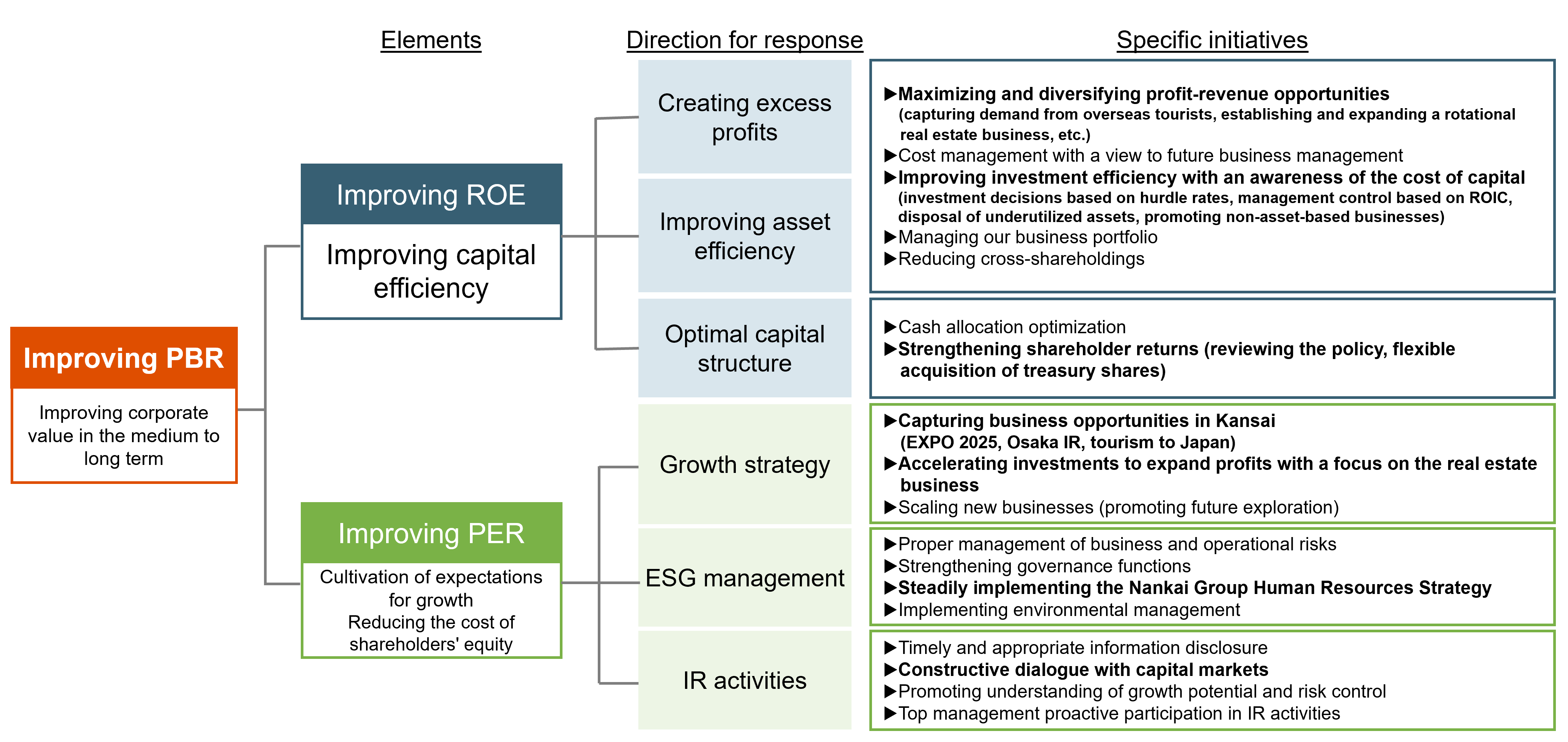

Financial strategy

[Basic policies]

・Given the improvement in our financial position, accelerate investments to expand profits and investment in safety and renewal,

while ensuring basic financial soundness.

・Increase corporate value over the medium to long term by working to optimize capital structure and improve PBR (ROE and PER),

considering the cost of capital and stock price.

・Secure investment funds by selling assets held and reducing cross-shareholdings.

[Shareholder return policy]

While upholding a policy of stable dividends, we will gradually increase the consolidated dividend payout ratio, aiming for around 30% by FY2027, and will flexibly acquire treasury shares as necessary

[Investment plan]

Intensive investment totaling 360 billion yen in a short-term

・Revenue expanding (includes future exploration):Up to 210.0 billion yen

・Safety and renewal:Up to 150.0 billion yen

[Response toward managing the company with an awareness of capital costs and stock prices]

We aim to improve PBR and corporate value by taking actions that contribute to improving both ROE and PER.

Numerical target

| Target indicators | Targets for FY2027 | Target level for the future |

|---|---|---|

| Operating income | 36.0 billion yen or more | 46.0 billion yen or more (by FY2035 at the earliest) |

| Ratio of the net interestbearing debt to EBITDA | In the 7 times range | In the 6 times range |

| ROE | Around 7% | 8% or more |

*EBITDA=Operating income + Depreciation and amortization + Goodwill amortization